TAX • 18 FEBRUARY 2021 • 1 MIN READ

GST on second hand goods

SECTIONS

What’s GST?

How does GST work in New Zealand?

GST on second hand goods

Other FAQs on GST

Who are Beany?

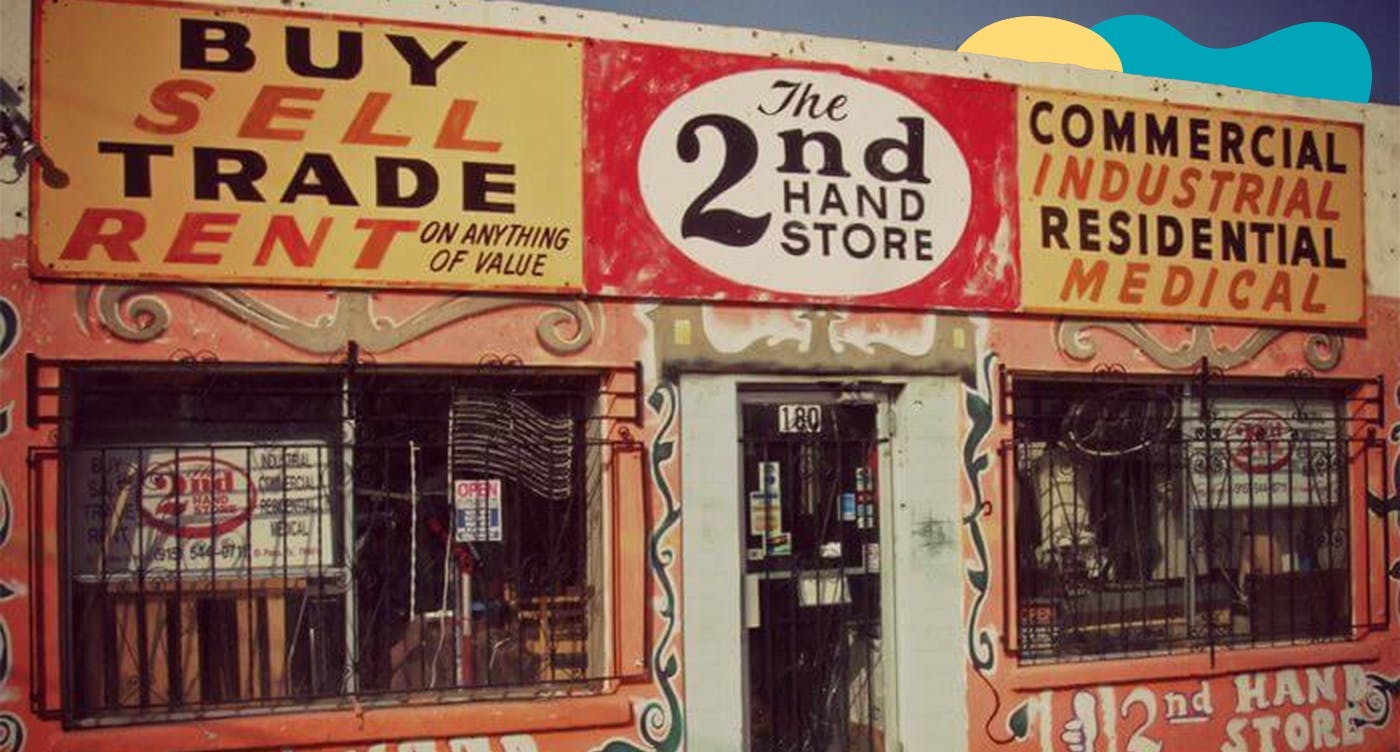

Let’s say, for example, you’re running a landscaping business and want to purchase a new piece of equipment. You may consider buying them second hand because they’re generally cheaper than the new ones. However, the question arises: how do I deal with the GST on second hand goods?

We quite often get asked if you can claim back the GST on second hand goods for your business from someone that isn’t GST registered. For example, you might buy a piece of business equipment for your cleaning business on TradeMe and the seller isn’t going to provide a nice GST invoice for your records. Or you bought a second hand printer for your design business.

Well, the good news is you can claim back the GST amount on your purchase even if the seller is not GST-registered.

Before we get started, let’s recap what’s GST and how GST works in New Zealand.

What’s GST?

GST stands for Goods and Service Tax. In New Zealand, GST is 15% added on top of the goods and/or services you sell. If you’re GST-registered, you can claim back the GST portion on the purchases of goods or services you use for taxable activities.

How does GST work in New Zealand?

The GST registration threshold is $60,000 in New Zealand. This means if your business's annual turnover exceeds $60,000, you need to register for GST. If your business's annual turnover is below this threshold, then GST registration is voluntary. This blog on how and when to register for GST explains this GST registration in more detail.

Once you become GST-registered, you must include 15% GST on top of the sales price of your goods and/or service. You’ll also need to issue GST invoices that meet IRD’s requirements.

Here are some important GST formulae you should know:

- Adding GST = the sales price*1.15

- Excluding GST portion = the sales price/1.15

GST on second hand goods

Here is how you can calculate the GST amount you can claim back. You take the total price paid (and note here, you have to have actually paid for it before you claim) and divide by 23 and multiply by 3 to get the GST portion. Alternatively, just pay through your business bank account and treat as a business purchase as a GST purchase in your software and that should do the trick.

For example, Anna bought a second hand printer for $100. The GST portion on this second-hand printer is $100*3/23= $13.04

You won’t get a GST invoice when purchasing from someone who is not GST-registered and there will be no GST charged for the second-hand goods you buy. In order to make GST claims, you still need to keep the records required by IRD.

Records

The only thing to note is that even if you don’t have a GST invoice, you still need to record the following:

- name and address of the supplier

- date of the purchase

- description of the goods

- quantity of goods

- price paid

Exception

The only exception to this general rule is if you’re buying from someone associated to you. So if you buy a car from your brother and he’s not GST registered then you can only claim the lowest of:

- purchase price

- current market value, or

- GST component (if any) of the original cost of the goods to the supplier

This is to prevent any tax shenanigans between mates or family!

Got any questions about Beany?

Chat to one of our friendly problem solvers today to get clarity.

Other FAQs on GST

1. Where can I find my GST number?

For sole traders, your GST number is the same as your IRD number. For companies and partnerships, the GST number is the same as your partnership or company IRD number.

2. What are zero-rated supplies?

Simply put, a GST rate of 0% is applied for zero-rated supplies. Zero-rated supplies are not the same as supplies that are exempted from GST (no GST is charged). Find more on how GST works for special transactions in this blog.

3. When is my GST return due?

In New Zealand, the GST filing frequency is monthly, bi-monthly, and six-monthly. According to your GST filing frequency, use our tax deadline calendar to help you figure out when your GST return is due.

Who are Beany?

We’re an online accounting firm that is always right here for you, your accounting pain relief. The most advanced technology lets us work way more closely with you than a normal accountant would.

We have a dedicated team of remote accountants to take care of your business no matter where you are, so you can focus on growing your business. We take out the ‘fluff’, break down the barriers and get things done. Looking out for you is what we are all about. Get started for free today.

subscribe + learn

Beany Resources delivered straight to your inbox.

Beany Resources delivered straight to your inbox.

Share:

Related resources

The basics business owners need to know about GST

March, 2021GST is a tax everyone pays on goods and services while living out their day-to-day lives. Businesses collect this ...

GST - special transactions

November, 2021GST can be a minefiled and there are some transactions that may require additional attention.

What is depreciation and what’s it for?

January, 2020Depreciation and the claims that are associated with assets can get a little complex which is why, typically, we so...